Exploring the realm of Costco Car Insurance Multi-Car Discounts: Case Study in Australia, this piece delves into the intricacies of saving money while insuring multiple vehicles. Get ready for a journey filled with insights and practical advice.

Overview of Costco Car Insurance Multi-Car Discounts

When it comes to car insurance, multi-car discounts can offer significant savings for households with more than one vehicle insured under the same policy. These discounts work by providing a reduced premium for each additional car added to the policy, compared to insuring each vehicle separately.

Opting for multi-car discounts with Costco Insurance in Australia can bring various benefits to policyholders, such as cost-effectiveness, convenience, and simplified management of policies for multiple vehicles. By bundling cars together under one policy, customers can streamline their insurance needs and potentially save money on premiums.

Benefits of Opting for Multi-Car Discounts with Costco Insurance

- Cost Savings: Multi-car discounts typically offer a lower premium rate for each vehicle insured, resulting in overall cost savings for policyholders.

- Convenience: Managing multiple car insurance policies under a single account with Costco Insurance can simplify the administrative tasks and make it easier to keep track of coverage details.

- Customized Coverage: Costco Insurance may offer tailored coverage options for multi-car policies, allowing customers to select the protection that best suits their needs.

Examples of How Multi-Car Discounts Can Help Save Money

- Scenario 1: A family with two cars decides to insure both vehicles under a multi-car policy with Costco Insurance. By bundling the cars together, they receive a discounted rate for each car, resulting in lower overall premiums compared to insuring each car separately.

- Scenario 2: A couple who each own a car chooses to combine their vehicles under one policy with Costco Insurance to take advantage of the multi-car discount. This decision leads to savings on insurance costs and simplifies the insurance process for both individuals.

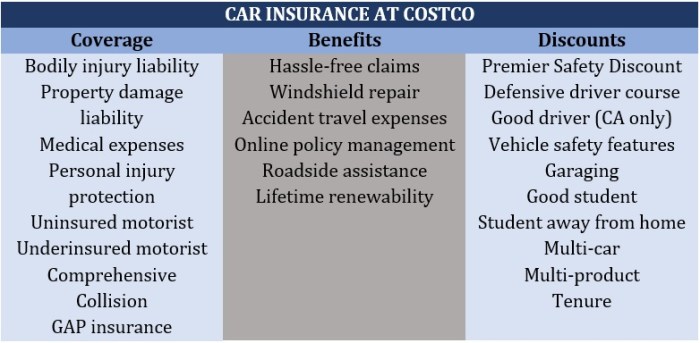

Costco Car Insurance Coverage Options

When it comes to coverage options, Costco Car Insurance offers a range of choices to suit different needs and preferences.

Types of Coverage Options

- Liability Coverage: This is mandatory and covers costs if you are at fault in an accident that causes injury or property damage to others.

- Collision Coverage: This helps pay for repairs to your vehicle after a collision, regardless of fault.

- Comprehensive Coverage: Protects your vehicle from non-collision damage such as theft, vandalism, or natural disasters.

- Uninsured/Underinsured Motorist Coverage: Covers you if you are in an accident with a driver who has no insurance or inadequate coverage.

Single Car Policies vs. Multi-Car Policies

With single car policies, each vehicle is insured individually with its own coverage limits and premiums based on factors specific to that vehicle.

On the other hand, multi-car policies offer the convenience of insuring multiple vehicles under one policy, often with discounted rates for each additional car.

By bundling multiple cars together, you may be able to save money on premiums compared to insuring each vehicle separately.

Impact of Adding Multiple Cars

- Increased Coverage Limits: Adding more cars to your policy can sometimes result in higher coverage limits to protect all vehicles adequately.

- Discounted Premiums: Insuring multiple cars together can lead to significant savings through multi-car discounts offered by Costco Car Insurance.

- Consolidated Policies: Managing one policy for multiple cars can simplify the insurance process and make it easier to keep track of coverage details.

Eligibility and Requirements for Multi-Car Discounts

When it comes to availing multi-car discounts with Costco Insurance, there are specific eligibility criteria and requirements that need to be met in order to qualify for these cost-saving benefits.

Eligibility Criteria

- Must insure more than one vehicle under the same policy.

- All vehicles must be registered to the same address.

- Drivers of the additional cars must meet the insurer's standards for age, driving history, and other factors.

Requirements for Multi-Car Discounts

- Provide proof of ownership for each vehicle being added to the policy.

- Ensure all vehicles meet the insurer's requirements for coverage and usage.

- Agree to the terms and conditions set forth by Costco Insurance for multi-car policies.

Limitations and Restrictions

- Some insurers may limit the number of vehicles that can be added to a single policy to qualify for multi-car discounts.

- Certain types of vehicles, such as classic cars or commercial vehicles, may not be eligible for multi-car discounts.

- Changes to the policy, such as adding or removing vehicles, may affect the overall discount applied.

Cost Savings and Financial Benefits

When it comes to insuring multiple cars through Costco Insurance, there are significant cost savings and financial benefits that can positively impact your household budget.

Potential Cost Savings

- Opting for multi-car discounts with Costco Insurance can lead to substantial savings on your overall insurance premiums. By bundling multiple cars under one policy, you may be eligible for discounted rates that are lower than insuring each vehicle separately.

- These cost savings can add up over time, providing you with more financial flexibility and potentially allowing you to allocate those savings towards other important expenses or investments.

Real-Life Examples

- For example, a family with three cars could save up to 20% on their insurance premiums by insuring all vehicles through Costco Insurance's multi-car discount program. This could result in hundreds of dollars in annual savings, which can make a significant difference in the household budget.

- Another case study showcases a couple who saved $300 per year by bundling their two cars under one policy with Costco Insurance's multi-car discount. This extra money allowed them to contribute more towards their children's education fund.

Impact on Household Budgeting

- By taking advantage of multi-car discounts offered by Costco Insurance, you can better manage your household budget by reducing the overall cost of insuring multiple vehicles.

- These savings can free up funds that can be allocated towards other essential expenses, such as mortgage payments, groceries, or savings for future goals like retirement or vacations.

Final Conclusion

In conclusion, the discussion on Costco Car Insurance Multi-Car Discounts: Case Study in Australia sheds light on the benefits of opting for this cost-saving option. Take charge of your insurance decisions and enjoy the financial advantages that come with insuring multiple cars.

Question Bank

What are the benefits of opting for multi-car discounts with Costco Insurance?

By insuring multiple vehicles under one policy, you can enjoy discounted rates and potentially save money on insurance premiums.

What are the eligibility criteria for availing multi-car discounts with Costco Insurance?

To qualify for multi-car discounts, you typically need to insure more than one vehicle under the same policy with Costco Insurance.

How can multi-car discounts impact overall household budgeting?

Opting for multi-car discounts can lead to significant cost savings, allowing you to allocate your budget more efficiently towards other expenses.