Delving into the realm of Auto Policy Quotes: Understanding Comprehensive vs Third-Party in UAE, this piece sets the stage for a comprehensive exploration of the nuances between these two types of insurance policies. Brace yourself for a journey filled with valuable insights and practical comparisons.

Discussing Auto Insurance Policies in UAE

Auto insurance is a crucial aspect of owning a vehicle in the UAE, providing financial protection in case of accidents or damages. There are two main types of auto insurance policies available - comprehensive and third-party.

Comprehensive Auto Insurance

Comprehensive auto insurance is a comprehensive coverage that provides protection for your vehicle against a wide range of risks and damages. This includes coverage for accidents, theft, fire, natural disasters, and more. It is the most extensive type of auto insurance policy available, offering peace of mind to vehicle owners.

Third-Party Auto Insurance

Third-party auto insurance, on the other hand, provides coverage for damages caused to third parties involved in an accident by your vehicle. This type of insurance is mandatory in the UAE and covers bodily injury or death of a third party, as well as property damage.

However, it does not cover damages to your own vehicle.

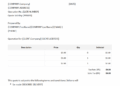

Comparison of Comprehensive and Third-Party Insurance

- Comprehensive insurance offers coverage for a wider range of risks and damages compared to third-party insurance.

- Comprehensive insurance provides coverage for your own vehicle, while third-party insurance only covers damages to third parties.

- Comprehensive insurance is optional but highly recommended for comprehensive protection, while third-party insurance is mandatory by law in the UAE.

- Comprehensive insurance premiums are higher than third-party insurance premiums due to the extensive coverage provided.

Understanding Comprehensive Auto Insurance

Comprehensive auto insurance provides extensive coverage for a wide range of incidents beyond just collisions. This type of policy is designed to protect your vehicle from various risks, offering a more complete level of protection compared to third-party insurance.

Types of Coverage Included

- Damage from natural disasters such as floods, hurricanes, and earthquakes.

- Theft of the vehicle or its components.

- Vandalism or malicious acts.

- Fire damage.

- Damage from falling objects.

- Animal collisions.

Examples of Beneficial Situations

Comprehensive coverage would be beneficial in scenarios such as:

- Your car gets stolen from a parking lot.

- Your vehicle sustains damage from a hailstorm or flooding.

- Your car catches on fire due to a faulty electrical system.

Limitations and Exclusions

While comprehensive insurance offers broad protection, there are certain limitations and exclusions to be aware of:

- Most policies have a deductible that you must pay before coverage kicks in.

- Some policies may not cover certain types of damage, such as wear and tear or mechanical failures.

- Coverage limits may apply to specific items inside the vehicle, like expensive electronics or aftermarket upgrades.

- Certain high-risk areas or situations may not be covered under a comprehensive policy.

Exploring Third-Party Auto Insurance

When it comes to auto insurance in the UAE, understanding the scope of coverage offered by third-party auto insurance is crucial. Let's delve into what this type of insurance entails and when it might be a suitable choice for drivers

Scope of Coverage Offered by Third-Party Auto Insurance

Third-party auto insurance provides coverage for damages or injuries caused to a third party by your vehicle. This means that if you are involved in an accident where you are at fault, the insurance will cover the costs incurred by the other party, including medical expenses and vehicle repairs.

Scenarios Where Opting for Third-Party Insurance Might Be Suitable

- For older vehicles with a lower value where comprehensive insurance might not be cost-effective.

- When the vehicle is used infrequently or for short distances, reducing the likelihood of accidents.

- For budget-conscious individuals looking for a more affordable insurance option.

Process of Filing a Claim Under a Third-Party Auto Insurance Policy

When filing a claim under a third-party auto insurance policy, you will need to inform your insurance provider immediately after the accident. Provide all necessary details such as the other party's information, accident report, and any relevant documentation. The insurance company will then assess the claim and handle the settlement process with the third party involved.

Factors Influencing Auto Insurance Premiums

When it comes to auto insurance premiums in the UAE, there are several key factors that can significantly impact the cost of both comprehensive and third-party coverage. Understanding these factors is crucial for individuals looking to get the best possible deal on their auto insurance.

Driving History

- Drivers with a history of accidents or traffic violations are considered high-risk by insurance companies, leading to higher premiums.

- Having a clean driving record can help lower insurance costs, as it demonstrates responsible driving behavior.

Type of Vehicle

- The make, model, and age of the vehicle can influence insurance premiums, with newer and more expensive cars typically costing more to insure.

- Safety features, such as airbags and anti-theft devices, can help reduce premiums by lowering the risk of theft or injury.

Usage of Vehicle

- The frequency and purpose of vehicle use, such as daily commuting or occasional leisure trips, can impact insurance costs.

- Higher mileage and commercial use of the vehicle may result in higher premiums due to increased risk of accidents.

Location

- Where the vehicle is primarily parked or driven can affect insurance premiums, with urban areas typically having higher rates due to increased traffic and crime rates.

- Garaging the vehicle in a secure location or neighborhood can help reduce the risk of theft or damage, potentially lowering premiums.

Deductibles and Coverage Limits

- Choosing higher deductibles and lower coverage limits can lower premiums, but may result in higher out-of-pocket expenses in the event of a claim.

- Conversely, opting for lower deductibles and higher coverage limits can provide more comprehensive protection, but at a higher cost.

Discounts and Bundling

- Insurance companies often offer discounts for factors such as bundling multiple policies, having a good credit score, or completing a defensive driving course.

- Exploring all available discounts and bundling options can help individuals save money on their auto insurance premiums.

Conclusive Thoughts

In conclusion, Auto Policy Quotes: Understanding Comprehensive vs Third-Party in UAE sheds light on the intricacies of choosing the right insurance coverage for your vehicle in the UAE. Armed with this knowledge, you can make informed decisions that align with your needs and budget.

FAQ Guide

What does comprehensive auto insurance cover?

Comprehensive auto insurance typically covers damage to your vehicle from theft, vandalism, natural disasters, and other non-collision incidents.

When would opting for third-party auto insurance be a suitable choice?

Opting for third-party auto insurance might be suitable for older vehicles with lower value where comprehensive coverage may not be cost-effective.

How can individuals potentially reduce their auto insurance premiums?

Individuals can potentially reduce their auto insurance premiums by maintaining a clean driving record, opting for a higher deductible, and bundling policies with the same insurer.