Delving into the realm of Automotive Insurance Quote: Fleet Coverage for Businesses in the UK, this piece sets the stage for an insightful journey, offering a comprehensive look at the intricacies of fleet insurance that businesses in the UK navigate.

Exploring the nuances of fleet coverage and its significance, this introductory paragraph unveils the complexities and considerations involved in insuring business vehicles in the UK.

Introduction to Fleet Coverage for Businesses in the UK

Fleet coverage for businesses in the UK refers to the insurance protection provided for a group of vehicles owned by a company or organization. This type of insurance is essential for businesses that rely on a fleet of vehicles to carry out their operations efficiently and effectively.Automotive insurance for fleet vehicles in the UK is crucial as it helps protect businesses from financial losses in case of accidents, theft, or damage to the vehicles.

It provides coverage for both the vehicles and the drivers, ensuring that the business can continue to operate smoothly even in the face of unforeseen circumstances.

Specific Needs and Challenges

- Businesses in the UK often have unique needs when it comes to insuring their fleet vehicles. These needs can vary depending on the size of the fleet, the types of vehicles involved, and the nature of the business operations.

- One of the main challenges faced by businesses is ensuring that all vehicles are adequately covered under the insurance policy. This includes ensuring that the policy provides adequate coverage for all types of risks that the vehicles may be exposed to.

- Another challenge is managing the costs associated with fleet insurance, as premiums can vary based on factors such as the age and driving history of the drivers, the value of the vehicles, and the level of coverage required.

Types of Fleet Coverage Options Available

When it comes to automotive insurance coverage for fleets in the UK, businesses have several options to choose from based on their needs and budget.

Comprehensive Coverage

Comprehensive coverage is the most extensive option available for fleet vehicles. This type of insurance not only covers damage to the fleet vehicles in case of an accident but also provides protection against theft, vandalism, and other non-collision related incidents.

While comprehensive coverage offers the most protection, it is also the most expensive option for businesses.

Third-Party Coverage

Third-party coverage is the most basic type of insurance required by law in the UK. This option covers damage caused to other vehicles or property in an accident involving fleet vehicles. However, it does not cover damage to the fleet vehicles themselves.

Third-party coverage is the most affordable option for businesses but offers limited protection.

Third-Party, Fire, and Theft Coverage

This type of coverage combines the basic third-party protection with coverage for fire damage and theft of fleet vehicles. While it offers more protection than third-party coverage alone, it is not as comprehensive as full coverage. Third-party, fire, and theft coverage strike a balance between protection and cost for businesses in the UK.

Factors Influencing Fleet Insurance Quotes

When it comes to determining the cost of automotive insurance quotes for fleet vehicles in the UK, several key factors come into play. These factors can significantly impact the pricing of fleet insurance and are essential for businesses to consider when seeking coverage.

Number of Vehicles

The number of vehicles in a fleet is a crucial factor that insurance companies take into account when providing quotes. Generally, the more vehicles you have in your fleet, the higher the insurance premium is likely to be. This is because a larger fleet poses a higher risk of accidents and claims.

Type of Vehicles

The type of vehicles in your fleet also plays a significant role in determining insurance quotes. Vehicles with higher horsepower, expensive price tags, or a history of frequent claims may result in higher premiums. On the other hand, safer and more economical vehicles could lead to lower insurance costs.

Drivers' Experience

The experience and driving records of the drivers operating the fleet vehicles can impact insurance quotes as well. Insurance companies often consider the age, driving history, and training of the drivers. Safer and more experienced drivers may lead to lower insurance premiums

Business Operations

The nature of your business operations can also influence fleet insurance quotes. Insurance providers assess the type of industry, the frequency of vehicle use, and the areas where the fleet operates. Certain industries or high-risk operations may result in higher insurance costs.

Risk Assessment, Claims History, and Security Measures

Insurance companies conduct risk assessments to evaluate the likelihood of claims and accidents within a fleet. A fleet with a history of frequent claims may face higher premiums. Implementing security measures such as GPS tracking, alarms, and immobilizers can help lower insurance costs by reducing the risk of theft and vandalism.

Obtaining and Comparing Insurance Quotes for Fleet Coverage

When it comes to obtaining automotive insurance quotes for fleet coverage in the UK, businesses need to follow a step-by-step process to ensure they get the best coverage at a competitive price. Comparing quotes from different insurers is crucial in making an informed decision that meets the specific needs of the fleet.

Step-by-Step Guide for Obtaining Insurance Quotes

Before diving into the process of obtaining insurance quotes, businesses should have a clear understanding of their fleet size, types of vehicles, and the level of coverage needed. Once these details are in place, they can follow these steps:

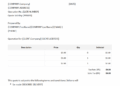

- Contact Multiple Insurers: Reach out to different insurance companies that offer fleet coverage and request quotes based on the information provided.

- Provide Accurate Information: Ensure that all details regarding the fleet are accurately presented to receive the most relevant and accurate insurance quotes.

- Compare Coverage Options: Review the coverage options offered by each insurer, considering factors such as liability limits, deductibles, and additional benefits.

- Review Terms and Conditions: Carefully examine the terms and conditions of each insurance quote to understand any exclusions or limitations that may impact coverage.

- Seek Professional Advice: Consult with insurance brokers or experts to gain insights into the best insurance options available for the fleet.

Importance of Comparing Insurance Quotes

Comparing insurance quotes from different insurers is essential for businesses looking to secure the most suitable coverage for their fleet. By comparing quotes, businesses can:

- Identify Cost-Effective Options: Compare pricing and coverage benefits to choose a cost-effective insurance plan that meets the fleet's requirements.

- Evaluate Coverage Limits: Assess the coverage limits and exclusions provided by each insurer to ensure comprehensive protection for the fleet.

- Understand Policy Terms: Gain clarity on the policy terms, conditions, and any additional services offered by insurers to make an informed decision.

Criteria for Comparing Insurance Quotes

When comparing insurance quotes for fleet coverage, businesses should consider the following criteria to select the most appropriate insurance plan:

- Cost: Evaluate the total cost of insurance premiums and any additional fees associated with the coverage.

- Coverage Options: Compare the types of coverage offered, including liability, comprehensive, and collision coverage.

- Claims Process: Review the claims process of each insurer to ensure a smooth and efficient claims experience in case of an incident.

- Customer Reviews: Consider feedback and reviews from other businesses regarding the insurer's customer service and claims handling.

- Customization Options: Look for insurers that offer customizable coverage options to tailor the policy to the specific needs of the fleet.

Final Conclusion

Wrapping up our discussion on Automotive Insurance Quote: Fleet Coverage for Businesses in the UK, this section encapsulates the key points covered, leaving readers with a deeper understanding of the topic and its implications for businesses.

FAQ Guide

What factors impact fleet insurance costs in the UK?

The number of vehicles, type of vehicles, drivers' experience, and business operations play significant roles in determining insurance quotes for fleet coverage in the UK.

How can businesses compare insurance quotes effectively?

Businesses can compare insurance quotes by obtaining multiple quotes from different insurers, considering coverage benefits, exclusions, and pricing to ensure they get the best coverage at a competitive price.