Exploring the realm of Automotive Insurance Quote for Classic Cars: UK & USA Special Considerations, readers are in for a ride filled with valuable insights and tips. Let's delve into the intricacies of insuring classic cars and uncover what sets them apart from regular vehicles.

Delving deeper into the nuances of insurance quotes for classic cars in the UK and USA, we unravel the factors that play a crucial role in determining premiums and coverage options.

Overview of Classic Car Insurance

Classic car insurance is a specialized type of coverage designed specifically for vintage and classic cars. These vehicles are typically older, well-maintained, and appreciated for their historical significance or collectible value.

Key Differences

- Agreed Value: Classic car insurance policies often offer an agreed value coverage, where the value of the vehicle is determined and agreed upon by the insurer and the owner. This ensures that in the event of a total loss, the owner receives the full agreed value without depreciation.

- Limited Usage: Classic car insurance usually comes with restrictions on how often the vehicle can be driven and for what purposes. This is because classic cars are not used as daily drivers and are often only taken out for special occasions or events.

- Specialized Repairs: Classic car insurance may include coverage for specialized repairs and replacement parts that may be harder to find or more expensive than those for regular vehicles.

Specialized Coverage Needs

Classic cars need specialized insurance coverage due to their unique characteristics and value. These vehicles are often irreplaceable and may require specific care and maintenance. Standard auto insurance may not adequately cover the value of a classic car or offer the specialized services needed to protect and preserve these vehicles.

Factors Affecting Insurance Quotes

When it comes to obtaining insurance quotes for classic cars in the UK and USA, there are several key factors that insurance companies take into consideration. These factors can greatly impact the cost of premiums and coverage options available to classic car owners.

Age of the Vehicle

The age of the classic car is a significant factor in determining insurance quotes. Generally, older vehicles are considered to be more valuable and may require higher insurance premiums to adequately cover their worth. Newer classic cars may also have higher replacement costs, impacting insurance rates.

Make and Model of the Vehicle

The make and model of a classic car can greatly influence insurance premiums. High-performance or rare models may be more expensive to insure due to higher repair or replacement costs. Additionally, the availability of parts for specific makes and models can impact insurance rates.

Usage of the Vehicle

How the classic car is used also plays a role in determining insurance costs. If the vehicle is only used for occasional pleasure drives or exhibitions, the insurance rates may be lower compared to a car that is driven regularly or used for racing events.

Modifications and Restoration Work

Any modifications or restoration work done on a classic car can affect insurance costs. Upgrades to the engine, suspension, or body of the vehicle can increase the value of the car, leading to higher insurance premiums. On the other hand, restoration work that improves the overall condition of the car may result in lower insurance rates.

Special Considerations for the UK Market

When it comes to insuring classic cars in the UK, there are some specific considerations that owners need to keep in mind. One of the key factors to take into account is the mileage restrictions and the availability of agreed value policies.

Mileage Restrictions and Agreed Value Policies

In the UK, classic car insurance policies often come with mileage restrictions. This means that the insurance provider may limit the number of miles you can drive your classic car in a given period. It's crucial for owners to accurately estimate their annual mileage to ensure they comply with these restrictions.

Agreed value policies are also common in the UK for classic cars. With this type of policy, you and the insurance company agree on the value of your vehicle upfront. In the event of a total loss, you will be reimbursed for the agreed upon value, rather than the actual cash value of the car at the time of the loss.

Importance of Limited Mileage Policies

Limited mileage policies are highly important for classic car owners in the UK. By restricting the number of miles driven annually, these policies help to minimize the risk of accidents and keep premiums lower. Owners are typically required to provide evidence of their mileage through MOT certificates or service records to ensure compliance with the policy terms.

Special Considerations for the USA Market

When it comes to insuring classic cars in the USA, there are some unique aspects to consider. From state-specific regulations to the role of classic car clubs, let's delve into the special considerations for classic car insurance in the USA.

State-Specific Regulations

In the USA, each state may have different regulations and requirements when it comes to classic car insurance. Some states may require specific coverage levels or have restrictions on how classic cars can be used. It's important to familiarize yourself with the regulations in your state to ensure compliance and adequate coverage.

Role of Classic Car Clubs/Associations

Classic car clubs or associations can play a significant role in obtaining insurance for your classic car in the USA. Many insurance companies offer specialized coverage or discounts for members of these clubs. Being part of a classic car community can also provide valuable resources and recommendations for insurance providers that specialize in classic cars.

Tips for Getting the Best Quote

When it comes to insuring your classic car, getting the best quote is crucial to ensure you have the right coverage at a reasonable cost. Here are some tips to help you secure the best insurance quote for your classic car.

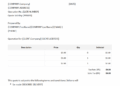

Importance of Documentation and Valuation

- Make sure you have all the necessary documentation for your classic car, including ownership records, maintenance history, and any restoration work that has been done.

- Get a professional valuation of your classic car to determine its true worth. This will help you get an accurate insurance quote based on the actual value of your vehicle.

- Keep all your documentation organized and up to date to present to insurance providers when requesting a quote.

Negotiating Premiums with Insurance Providers

- Shop around and compare quotes from different insurance providers to find the best deal for your classic car coverage.

- Consider bundling your classic car insurance with other policies, such as home or life insurance, to potentially get a discount on your premiums.

- Ask about available discounts for things like safe driving records, low mileage, or membership in a classic car club.

- Be prepared to negotiate with insurance providers and don't be afraid to ask for a better rate based on your specific needs and circumstances.

Conclusion

Wrapping up our discussion on Automotive Insurance Quote for Classic Cars: UK & USA Special Considerations, we've navigated through the complexities of insuring vintage vehicles with finesse. Remember, securing the best quote is not just about cost, but also about tailored coverage that suits your prized possession.

FAQs

What factors differentiate classic car insurance from regular car insurance?

Classic car insurance takes into account the unique value and limited usage of vintage vehicles, offering specialized coverage not typically found in standard policies.

How can classic car owners negotiate better premiums with insurance providers?

Owners can negotiate by providing detailed documentation of the vehicle's condition, mileage, and any restoration work done. Building a good rapport with insurers and exploring discounts can also help in securing better rates.

What role do classic car clubs play in obtaining insurance in the USA?

Classic car clubs can sometimes offer group insurance rates and provide resources for finding specialized insurers that understand the unique needs of vintage car owners.