Starting off with Discount Car Insurance Quotes: How to Get Extra Savings in India, this introduction aims to provide a compelling overview of the topic, setting the stage for what's to come.

Following this, the subsequent paragraph will delve deeper into the details and specifics of the subject matter.

How to Obtain Discount Car Insurance Quotes in India

To get the best possible deal on car insurance in India, it's essential to compare quotes from different providers. Here's how you can go about obtaining discount car insurance quotes:

Search and Compare Quotes

- Start by researching and identifying reputable car insurance providers in India.

- Visit the official websites of these providers to request quotes based on your specific requirements.

- Consider using online comparison platforms that allow you to input your details once and receive multiple quotes from different insurers.

Understanding Discounts

- Learn about the various discounts available for car insurance in India, such as no-claim bonus, anti-theft device installation discounts, and discounts for opting for voluntary deductibles.

- Understand the eligibility criteria for each discount and how it can help reduce your insurance premium.

Online Tools for Comparison

- Utilize online tools and calculators offered by insurance providers to compare quotes and coverage options easily.

- Enter your vehicle details, personal information, and coverage preferences to receive instant quotes from multiple insurers.

- Take advantage of customer reviews and ratings on these platforms to make an informed decision while choosing a car insurance policy.

Factors Influencing Discount Car Insurance Quotes

When it comes to obtaining discount car insurance quotes in India, several key factors play a significant role in influencing the cost of car insurance premiums. Factors such as age, driving history, type of vehicle, and location can impact the availability of discounts.

Additionally, maintaining a good credit score can also potentially lead to lower car insurance quotes.

Age

Age is a crucial factor that insurance companies consider when determining car insurance premiums. Younger drivers, especially those under the age of 25, are often considered high-risk drivers and may end up paying higher premiums compared to older, more experienced drivers.

Driving History

A driver's past driving record is another important factor that affects car insurance rates. Drivers with a history of accidents or traffic violations are deemed riskier to insure and may face higher premiums. On the other hand, drivers with a clean record are likely to receive lower insurance quotes.

Type of Vehicle

The type of vehicle being insured also influences car insurance premiums. Expensive or high-performance vehicles typically come with higher insurance costs due to the increased risk of theft or damage. On the contrary, insuring a budget-friendly and safe vehicle can result in lower insurance quotes.

Location

The location where the car is primarily driven and parked plays a role in determining insurance rates. Urban areas with higher rates of accidents or theft may lead to higher premiums compared to rural areas with lower risks. Therefore, the location of the insured vehicle can impact the availability of discounts.

Credit Score

Maintaining a good credit score can have a positive impact on car insurance premiums. Insurance companies may offer lower quotes to individuals with higher credit scores as they are perceived as more financially responsible and less likely to file claims

Therefore, improving and maintaining a good credit score can potentially lead to discounted car insurance rates.

Strategies for Getting Extra Savings on Car Insurance

When it comes to car insurance, finding ways to save money is always a priority for policyholders. By implementing certain strategies, individuals can increase their chances of qualifying for additional discounts on their car insurance premiums. From bundling insurance policies to installing safety features in their vehicles, there are several tactics that can help reduce insurance costs.

Benefits of Bundling Insurance Policies

One effective way to secure extra savings on car insurance is by bundling multiple insurance policies with the same provider. By combining auto insurance with other types of coverage such as home insurance or life insurance, policyholders can often enjoy discounted rates and lower overall premiums.

Installing Safety Features in a Vehicle

Another strategy to consider for reducing car insurance premiums is to install safety features in the vehicle. Safety features such as anti-theft devices, airbags, and backup cameras can help minimize the risk of accidents or theft, leading to lower insurance costs.

Insurance companies often offer discounts for vehicles equipped with these safety features, making it a worthwhile investment for policyholders.

Comparison of Different Car Insurance Plans in India

When it comes to choosing a car insurance plan in India, it is essential to compare and contrast the features, coverage, and discounts offered by popular insurance providers. This comparison can help you identify the best plan that suits your needs and budget while maximizing potential savings.

Additionally, understanding the pricing structures and reading the fine print of insurance policies is crucial to ensure you get the most out of your coverage.

Features, Coverage, and Discounts Offered

- Insurance Provider A: Offers comprehensive coverage with add-on benefits such as roadside assistance and zero depreciation. They provide discounts for safe driving records and loyalty bonuses for renewals.

- Insurance Provider B: Focuses on affordable premiums with basic coverage options. They offer discounts for installing anti-theft devices and opting for long-term policies.

- Insurance Provider C: Specializes in tailor-made plans with customizable coverage options. They provide discounts for bundled policies and online purchase.

Pricing Structures Analysis

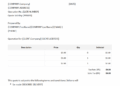

| Insurance Provider | Base Premium | Add-Ons | Discounts |

|---|---|---|---|

| Provider A | Higher | Extensive | Safe driving, loyalty |

| Provider B | Affordable | Basic | Anti-theft, long-term |

| Provider C | Customizable | Tailored | Bundled, online purchase |

It is important to analyze the pricing structures of different car insurance plans to identify potential savings and choose the best option for your needs.

Reading the Fine Print

- Always read the terms and conditions of insurance policies to understand the extent of discounts and coverage offered by each plan.

- Pay attention to exclusions, limitations, and claim procedures to avoid any surprises during the claims process.

- Clarify any doubts with the insurance provider to ensure you are fully aware of what is covered and what is not under your policy.

Final Summary

Wrapping up our discussion on Discount Car Insurance Quotes: How to Get Extra Savings in India, the conclusion will offer a concise summary and closing remarks to leave a lasting impact.

Question Bank

How can I find the best discount car insurance quotes in India?

To find the best deals, compare quotes from multiple providers, consider different types of discounts available, and leverage online tools for easy comparison.

What factors impact the cost of car insurance premiums in India?

Key factors include age, driving history, vehicle type, and location, which can affect the availability of discounts. A good credit score can also lead to lower insurance quotes.

How can I get extra savings on car insurance policies?

Increasing chances for discounts can be done by bundling policies, installing safety features in your vehicle, and maintaining a good driving record.

What should I consider when comparing different car insurance plans in India?

Compare features, coverage, and discounts offered by various providers, analyze pricing structures for potential savings, and always read the policy details thoroughly.