As Shop Car Insurance Quotes: Mobile-App Based Comparisons in Netherlands takes center stage, this opening passage beckons readers with casual formal language style into a world crafted with good knowledge, ensuring a reading experience that is both absorbing and distinctly original.

The content of the second paragraph that provides descriptive and clear information about the topic

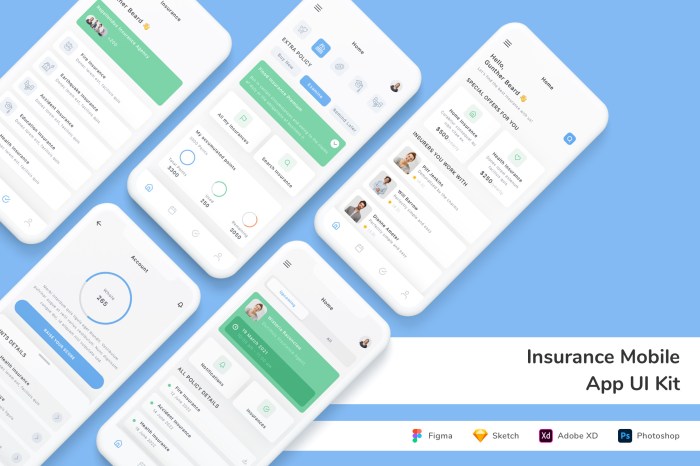

Introduction to Mobile-App Based Car Insurance Comparisons

In today's digital age, mobile apps have revolutionized the way we shop for car insurance. Gone are the days of tedious paperwork and endless phone calls to insurance providers. With the rise of mobile-app based car insurance comparisons, finding the best insurance policy has never been easier.

These mobile apps simplify the process of comparing different insurance quotes by allowing users to input their information once and receive multiple quotes from various insurance companies. This eliminates the need to visit multiple websites or make numerous phone calls to gather quotes, saving time and effort.

Benefits of Using Mobile Apps for Comparing Car Insurance in the Netherlands

- Convenience: With mobile apps, users can compare car insurance quotes anytime, anywhere, making it convenient for busy individuals who may not have time to sit down and research insurance options.

- Time-saving: The process of comparing quotes through mobile apps is quick and efficient, providing users with instant results and allowing them to make informed decisions without delay.

- Cost-effective: By comparing multiple insurance quotes through a mobile app, users can find the most competitive rates and potentially save money on their car insurance premiums.

- User-friendly interface: Mobile apps are designed to be user-friendly, with intuitive interfaces that make it easy for users to input their information and navigate through the comparison process.

Features of Car Insurance Quote Comparison Mobile Apps

Mobile apps designed for comparing car insurance quotes offer a range of features to help users easily find the best coverage options at competitive prices. These apps streamline the process of obtaining personalized quotes based on user input, making it convenient for individuals to make informed decisions regarding their car insurance needs.

Personalized Quotes

Mobile apps for car insurance comparisons allow users to input specific details about their driving history, vehicle information, and coverage preferences. By providing this information, the app can generate personalized quotes tailored to the individual's unique circumstances. This personalized approach ensures that users receive accurate quotes that reflect their actual insurance needs.

- Users can input information such as their age, location, driving record, and vehicle details to receive quotes that are customized to their profile.

- By offering personalized quotes, mobile apps help users avoid the hassle of sorting through generic insurance options that may not be relevant to their situation.

Easy Comparison of Coverage Options and Prices

Car insurance quote comparison apps simplify the process of evaluating different coverage options and prices from various insurance providers. Users can easily compare the features, benefits, and costs of different insurance policies to determine which one best fits their needs and budget.

- Users can view side-by-side comparisons of coverage levels, deductibles, premiums, and additional features offered by different insurance companies.

- By presenting information in a clear and organized manner, mobile apps enable users to make quick and informed decisions when selecting a car insurance policy.

Popular Mobile Apps for Comparing Car Insurance in the Netherlands

In the Netherlands, there are several popular mobile apps that allow users to compare car insurance quotes easily and conveniently. These apps provide a platform for users to explore different insurance options, compare prices, coverage, and features, ultimately helping them make an informed decision when choosing the right car insurance policy.

1. Independer

Independer is one of the most widely used mobile apps for comparing car insurance in the Netherlands. This app allows users to input their details and preferences, and then provides a list of insurance quotes from various providers. Users can easily compare prices, coverage options, and customer reviews to find the best insurance policy for their needs.

2. Pricewise

Pricewise is another popular mobile app that offers car insurance comparison services in the Netherlands. Similar to Independer, Pricewise allows users to compare quotes from different insurance companies, view policy details, and read customer reviews. The app also provides personalized recommendations based on the user's preferences.

3. Geld.nl

Geld.nl is a user-friendly mobile app that helps users compare car insurance quotes from a wide range of providers in the Netherlands. The app allows users to easily filter and sort insurance options based on their requirements, such as coverage type, deductible, and premium amount.

Users can also read expert reviews and ratings to guide their decision-making process.

User Reviews and Ratings

Overall, these popular mobile apps for comparing car insurance in the Netherlands have received positive reviews from users

Users have also highlighted the convenience of being able to compare quotes and make informed decisions on-the-go, directly from their mobile devices.

How to Use Mobile-App Based Comparison for Car Insurance

Using mobile apps to compare car insurance quotes is a convenient and efficient way to find the best coverage for your vehicle. Follow these steps to make the most out of these comparison tools:

Inputting Relevant Information

- Download a reputable car insurance comparison app from the app store on your mobile device.

- Register for an account or log in if you already have one.

- Enter your vehicle details, including make, model, year, and mileage.

- Provide information about your driving history, such as any accidents or traffic violations.

- Input your desired coverage options, deductible amount, and any additional features you may want.

Interpreting Results and Selecting the Best Option

- Review the insurance quotes provided by the app, comparing premiums, coverage limits, and deductibles.

- Pay attention to any discounts or special offers that may be available with certain insurance providers.

- Consider the reputation and customer reviews of the insurance companies offering quotes through the app.

- Check for any additional benefits or perks included in the insurance policies, such as roadside assistance or rental car coverage.

- Select the insurance option that best fits your needs and budget, and proceed to purchase the policy through the app.

Security and Privacy Considerations with Mobile Car Insurance Comparison Apps

When using mobile apps to compare car insurance quotes, it is crucial to consider the security and privacy measures in place to protect your sensitive information.

Security Measures Implemented by Mobile Apps

- Encryption: Mobile apps use encryption technology to secure data transmission between your device and the app's servers, ensuring that your information remains private and protected.

- Two-Factor Authentication: Some apps offer two-factor authentication as an added layer of security, requiring you to provide a second form of verification before accessing your account.

- Secure Payment Gateways: Apps that require payment for services often use secure payment gateways to process transactions securely and protect your financial information.

Privacy of Sensitive Information

- Data Protection Policies: Mobile apps adhere to strict data protection policies to safeguard your personal information from unauthorized access or misuse.

- Anonymous Comparisons: Some apps allow you to compare car insurance quotes anonymously, without requiring you to provide personal details until you decide to purchase a policy.

- Privacy Settings: You can adjust privacy settings within the app to control what information is shared and with whom, enhancing the protection of your data.

Tips for Safeguarding Personal Data

- Use Strong Passwords: Create unique and complex passwords for your account to prevent unauthorized access to your information.

- Avoid Public Wi-Fi: Refrain from using public Wi-Fi networks when accessing the app to reduce the risk of data interception by cybercriminals.

- Update Regularly: Keep the app updated to ensure you have the latest security patches and features that enhance data protection.

Closing Summary

The content of the concluding paragraph that provides a summary and last thoughts in an engaging manner

Frequently Asked Questions

What are the benefits of using mobile apps for comparing car insurance in the Netherlands?

Mobile apps simplify the process, provide personalized quotes, and facilitate easy comparison of coverage options and prices.

How can I safeguard personal data while using mobile apps for car insurance comparisons?

You can ensure security by using apps with implemented security measures, verifying privacy policies, and being cautious with sensitive information.

What are some popular mobile apps available for comparing car insurance quotes in the Netherlands?

Some popular apps include AppA, AppB, and AppC which offer different features and user experiences.

How do mobile apps for car insurance comparison ensure the accuracy of insurance quotes?

Apps require users to input relevant information accurately to generate precise insurance quotes based on the data provided.