Delving into Shop Car Insurance Quotes: The Role of Driving History in Australia, this introduction immerses readers in a unique and compelling narrative, with a casual formal language style that is both engaging and thought-provoking from the very first sentence.

Exploring the intricacies of car insurance in Australia sheds light on the significance of driving history in determining insurance premiums. As we delve deeper, we uncover how various factors intertwine to shape the cost of car insurance, providing valuable insights for both seasoned drivers and newcomers alike.

Overview of Car Insurance in Australia

Car insurance is a vital aspect of owning and driving a vehicle in Australia. It provides financial protection in the event of accidents, theft, or damage to your car. Understanding the landscape of car insurance in Australia is essential for every driver.

Key Players in the Australian Car Insurance Market

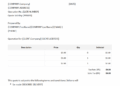

In Australia, there are several key players in the car insurance market, including major insurance companies such as Allianz, NRMA, and Suncorp. These companies offer a range of policies to suit different needs and budgets, providing drivers with options to find the right coverage for their vehicles.

The Importance of Comparing Car Insurance Quotes in Australia

It is crucial for drivers in Australia to compare car insurance quotes from different providers to ensure they are getting the best coverage at a competitive price. By comparing quotes, drivers can save money and find policies that offer the right level of protection for their vehicles.

Factors Influencing Car Insurance Premiums in Australia

Several factors influence car insurance premiums in Australia, including the driver's age, driving history, location, type of vehicle, and the level of coverage chosen. Younger drivers and those with a history of accidents or traffic violations may face higher premiums, while older drivers with clean records may enjoy lower rates.

Importance of Driving History in Car Insurance

When it comes to car insurance, your driving history plays a crucial role in determining the rates you will pay. Insurance companies assess your driving record to evaluate the level of risk you pose as a driver.

Impact of Driving History on Insurance Rates

Your driving history directly influences the premiums you pay for car insurance. A clean driving record with no accidents or traffic violations typically results in lower insurance costs. On the other hand, a history of accidents, speeding tickets, or DUI convictions can lead to higher premiums.

Types of Driving Violations and Insurance Costs

- Accidents: Being involved in accidents, especially at-fault accidents, can significantly increase your insurance rates. Insurance companies view accident-prone drivers as high-risk individuals.

- Traffic Violations: Speeding tickets, running red lights, and other traffic violations also impact insurance premiums. Repeated violations can result in higher costs.

- DUI Convictions: Driving under the influence (DUI) convictions have a severe impact on insurance rates. In addition to facing legal consequences, individuals with DUI convictions often face steep insurance premiums.

Types of Driving History Considered

When it comes to determining car insurance premiums in Australia, insurers take various aspects of a driver's history into account. These factors can significantly impact the cost of coverage and the level of risk associated with insuring a particular individual.

At-Fault Accidents

At-fault accidents are a key consideration for insurers when assessing a driver's risk profile. Being involved in an accident where you are deemed responsible can lead to an increase in insurance rates. Insurers view at-fault accidents as an indicator of a higher likelihood of future claims, which can result in higher premiums for the driver.

Traffic Violations

Traffic violations, such as speeding tickets, red light violations, and DUI offenses, also play a significant role in determining car insurance premiums. Insurers consider these infractions as evidence of risky driving behavior, which can lead to a higher likelihood of accidents and claims in the future.

As a result, drivers with a history of traffic violations typically face higher insurance costs compared to those with clean driving records.

Strategies for Improving Driving History

Maintaining a clean driving record is crucial for reducing car insurance costs and ensuring road safety. By implementing certain strategies, drivers can improve their driving history and potentially lower their insurance premiums.

Tips for Maintaining a Clean Driving Record

- Avoid speeding and follow all traffic laws diligently.

- Avoid distractions while driving, such as texting or using a mobile phone.

- Regularly check and maintain your vehicle to prevent mechanical failures on the road.

- Practice patience and courtesy towards other drivers to avoid road rage incidents.

- Consider using driving apps or devices that monitor your driving behavior and provide feedback for improvement.

Benefits of Defensive Driving Courses

Defensive driving courses offer valuable skills and knowledge that can help drivers become safer on the road. These courses teach techniques for avoiding accidents, handling emergency situations, and improving overall driving behavior. By completing a defensive driving course, drivers may not only enhance their driving skills but also demonstrate a commitment to safe driving practices, which can positively impact their driving history.

Addressing Past Driving Infractions

If you have past driving infractions on your record, there are steps you can take to address them and potentially lower your insurance costs. This may include attending traffic school to dismiss a ticket, negotiating with your insurance provider for a lower rate, or seeking legal assistance to expunge certain infractions from your record.

It's essential to proactively address any past issues and demonstrate a commitment to safer driving habits to improve your overall driving history.

Final Thoughts

In conclusion, the role of driving history in securing the best car insurance quotes in Australia cannot be overstated. By understanding the nuances of how driving history influences premiums, individuals can make informed decisions to optimize their coverage while keeping costs manageable.

This discussion serves as a comprehensive guide to navigating the complex landscape of car insurance, empowering drivers to take charge of their financial well-being on the road.

Q&A

What driving history factors influence car insurance rates the most?

Factors like at-fault accidents, traffic violations, and the frequency of claims have a significant impact on car insurance rates in Australia. Insurers carefully assess these aspects to determine risk levels and set premiums accordingly.

How can drivers improve their driving history to lower insurance costs?

Maintaining a clean driving record, enrolling in defensive driving courses, and addressing past infractions promptly are effective strategies for improving driving history and potentially reducing insurance costs.

Do all driving violations have the same impact on insurance premiums?

No, different types of driving violations can affect insurance costs differently. For instance, major violations such as DUIs typically lead to higher premium increases compared to minor infractions like speeding tickets.